Settings

In the app setting page you can choose how the A-Cube e-invoicing app must behave within your Stripe account. You can reach the settings page by clicking on the three dots on the top right of the app view.

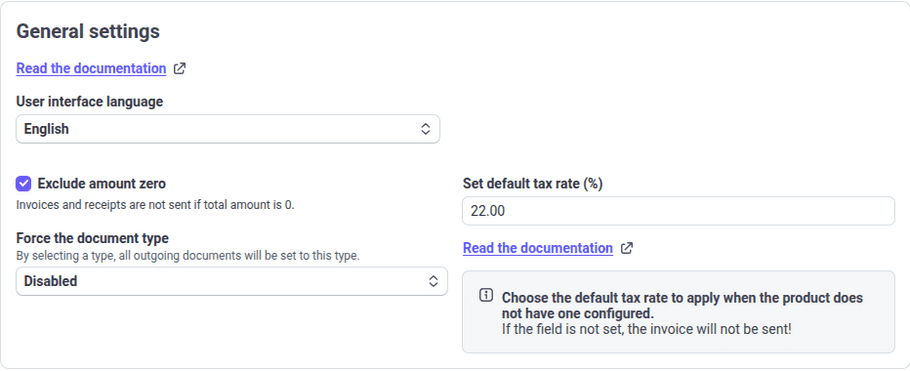

General preferences

User interface language

Choose the language of the A-Cube e-invoicing app, supported languages are English, Italian, Polish

Exclude amount zero

You can choose to not send invoices if total amount is equal to zero.

Set default tax rate (%)

Choose a default tax rate to apply when the product or the payment intent does not have a configured VAT rate. If no VAT rate is found, the invoice or the receipt will not be sent.

Force the document type

Choose a document type to apply, the app will create only documents of the selected type.

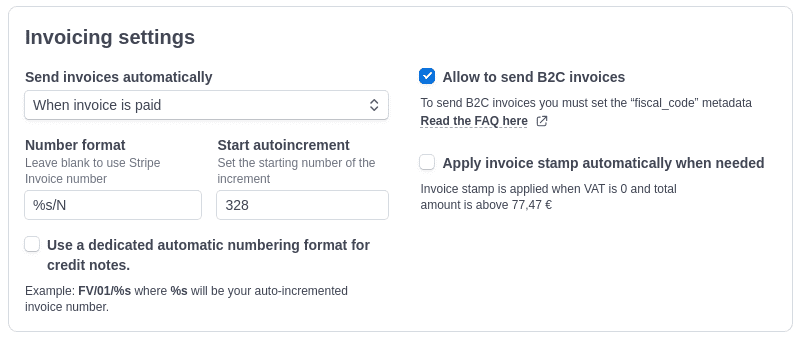

Invoicing settings

Send invoices automatically

- Off (manual sends)

This is the default configuration. In this case you will need to click the "Send" button for each invoice you want to send to SDI. - When invoice is finalized (open)

Applies only case you use Stripe Invoice (part of Stripe Billing See Stripe docs) - When a customer pays

Work with both Stripe Invoice and Stripe Payments. The invoice will be sent when the payment is completed.

Invoice number format and Start autoincrement

Leave this field blank if you want to apply the same invoice number of the Stripe Invoice to the e-invoice. In case you want A-Cube to manage the numbering, fill it with a pattern, in example:S1/%s, where %s will be your auto-incremented invoice number.Start autoincrement is the number that will be used as the first invoice number.

Allow to send B2C invoices

You can choose to send B2C invoices, in this case you need to set up afiscal_code field (in Italy it's the so called 'codice fiscale') in the metadata of the customer.Apply invoice stamp automatically when needed

If selected and if the invoice total amount is more than 77.47€ and the vat rate is zero, then the e-invoice will be compliant with theDatiBollo field.

A new line item will be added to the e-invoice with the stamp amount of 2€.

The total amount of the first line matching having the Natura field set will be decreased by 2€ in order to keep the invoice total amount the same of what has been paid by the customer.Smart receipt settings

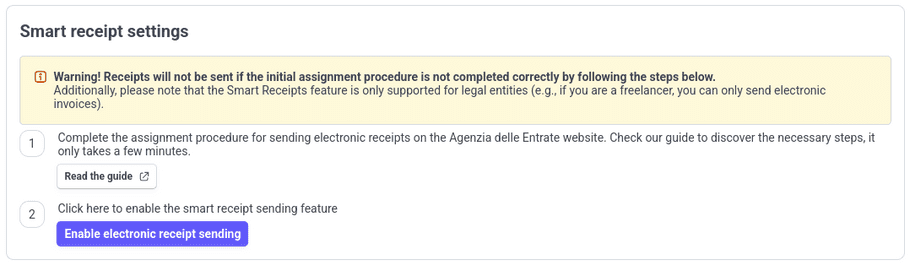

Activate smart receipts

Smart receipts can be enabled by appointing A-Cube to send receipts on your behalf.

The process is divided into two steps:

- Read and follow the guide

Click on the "Read and follow the guide" button to open the webpage in a new tab. It will guide you through the process of appointing A-Cube to send receipts on your behalf through your "Agenzia delle Entrate" account. - Enable smart receipts

Once you have followed the guide and appointed A-Cube, you can enable smart receipts by clicking on the "Enable smart receipts" button. If the process is successful, you will see a confirmation message and the section will update.

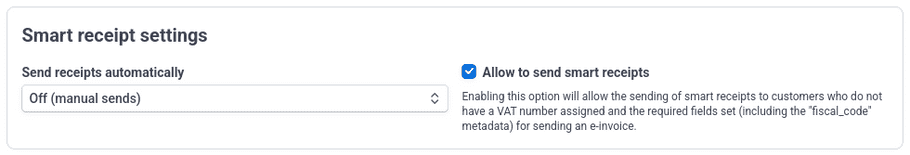

Once the appointing procedure is completed with success, the Smart Receipts section will appear as follows:

Send receipts automatically

- Off (manual sends)

This is the default configuration. In this case you will need to manually click the "Send" button for each receipt you want to send to the government. - When a customer pays

Work with both Stripe Invoice and Stripe Payments. The receipt will be sent when the payment is completed.

Allow to send smart receipts

You can use this option to enable or disable completely the sending of smart receipts.

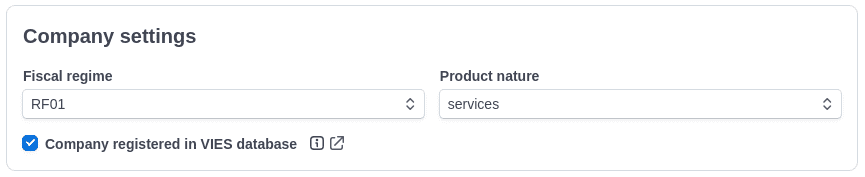

Your company

Fiscal regime

Choose between RF01 or RF19 based on your company tax regime in Italy.

Product nature

Choose between goods or services. This information is useful when calculating the "Natura" field of the VAT in case the VAT is zero.

Company registered in VIES database

Select this option in case your company is registered in the VIES database. You can verify this here. This information is useful when calculating the "Natura" field of the VAT in case the VAT is zero.