Credit Notes

Credit notes are documents used to correct a previously issued invoice. Are used to reduce the amount of an invoice that has already been issued to a customer or to void it entirely.

Credit notes can be managed by the A-Cube e-invoicing app in both cases where your integration uses Stripe Invoice or Stripe Payments.

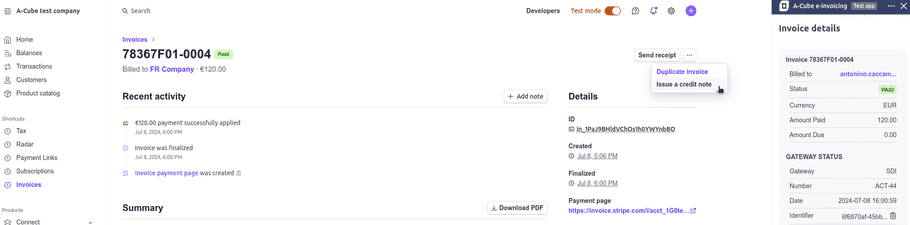

Stripe Invoice

The procedure to manage credit notes with Stripe Invoice is the following:

- Create a credit note starting from an existing Stripe Invoice.

- Issue the Stripe Credit Note and you will see automatically appear a new credit note in the A-Cube e-invoicing app too.

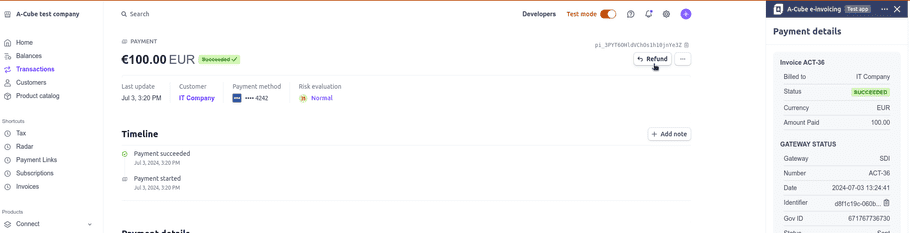

Stripe Payments

The procedure to manage credit notes with Stripe Payments is the following:

- Create a refund starting from an existing Stripe Payment.

- Click on the Refresh button on the A-Cube e-invoicing app to see the new refund appear in the list of credit notes.

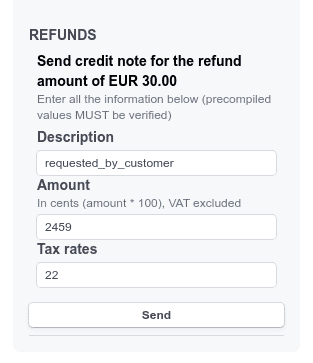

- You will see a form to create a new credit note starting from the refund. The form is pre-filled with the data of the refund, but you can change the amount, the description and the vat rate of the credit note.

Note 1 The amount is expressed in cents (e.g. 1000 means 10.00 EUR).

Note 2 The amount must be provided unbundled, i.e. without VAT. In example for a refund of 30.00 EUR and a VAT RATE of 22% the amount must be2459 (30.00 * 100 / 1.22).